Contents

Course Outline

Description: A Course Outline details topics, objectives, schedule, and assessments, guiding students through the curriculum.

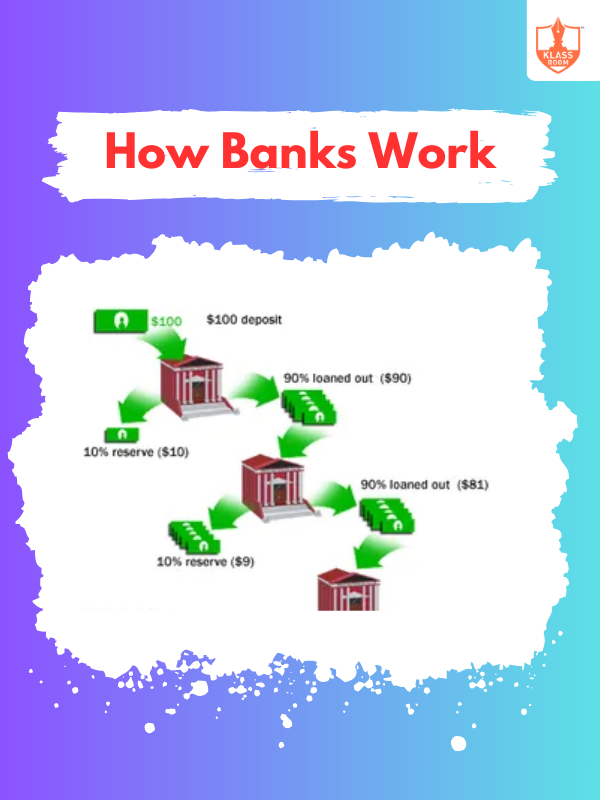

How Banks Work

Description: Banks accept deposits, provide loans, facilitate transactions, manage finances, and support economic growth.

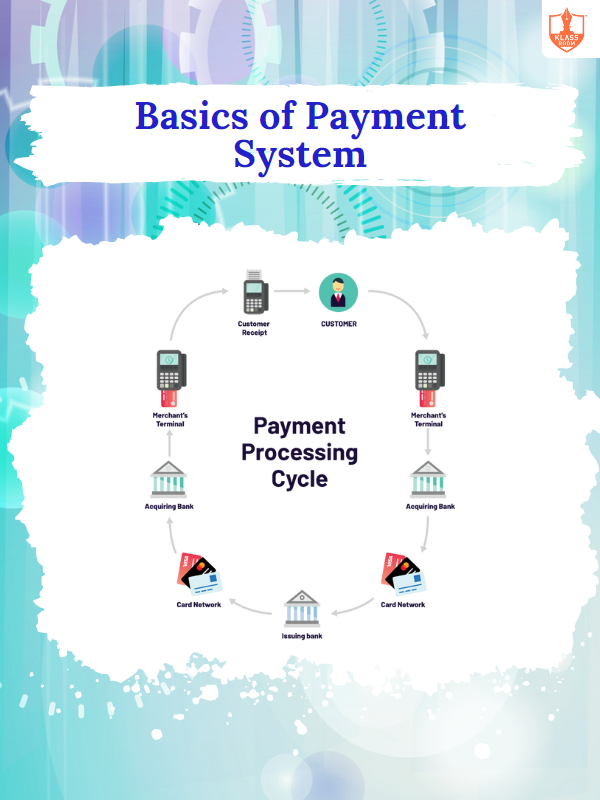

Basics of Payment System

Description: Payment systems enable secure, efficient transfer of funds between parties through various electronic or physical methods.

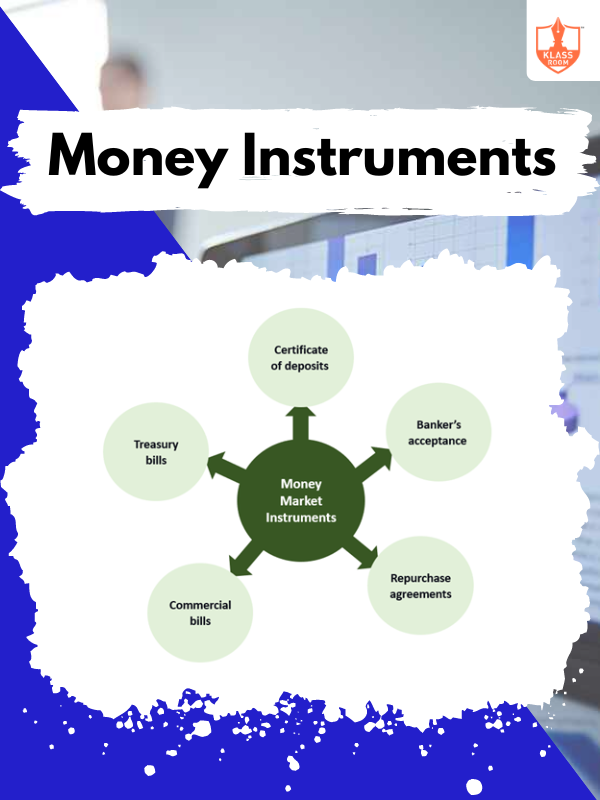

Money Instruments

Description: Money instruments include cash, checks, credit/debit cards, and digital wallets for making payments and transactions.

Open Banking

Description: Open Banking allows secure data sharing between banks and third parties, enhancing financial services and innovation.

UPI

Description: UPI (Unified Payments Interface) enables instant, real-time bank transfers using mobile devices, simplifying digital payments.

Card Payments

Description: Card payments use credit or debit cards to make transactions electronically, offering convenience and security.

BAAS

Description: BAAS (Banking-as-a-Service) provides banking functions via APIs, enabling fintech's to offer financial services seamlessly.

Regulation in India, UK, and US

Description: Regulation varies: India focuses on central authority, UK on independent bodies, and US on sector-specific agencies.

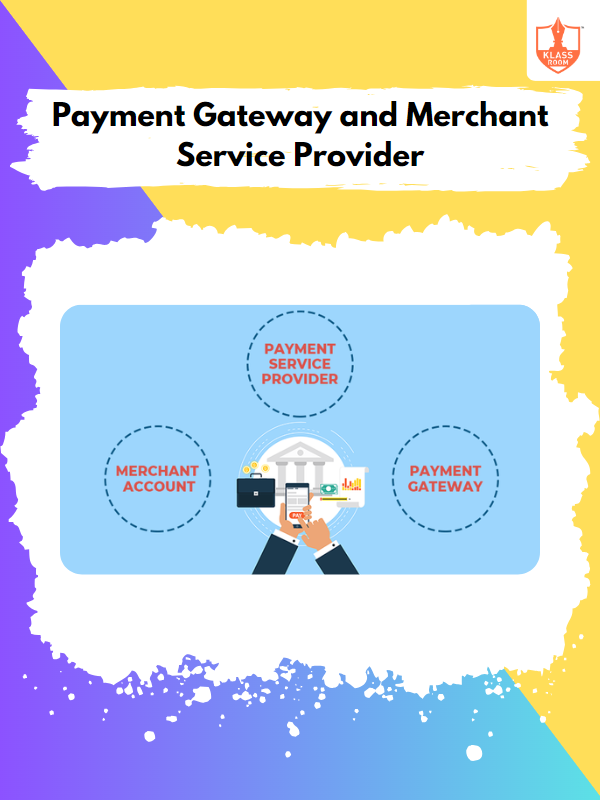

Payment Gateway and Merchant Service Provider

Description: Payment gateways process online transactions securely, while merchant service providers handle payment processing and merchant accounts.

KYB and AML

Description: KYB (Know Your Business) and AML (Anti-Money Laundering) are processes to verify business legitimacy and prevent financial crimes.

Fraud Prevention

Description: Fraud prevention involves strategies and tools to detect, prevent, and mitigate fraudulent activities in businesses.

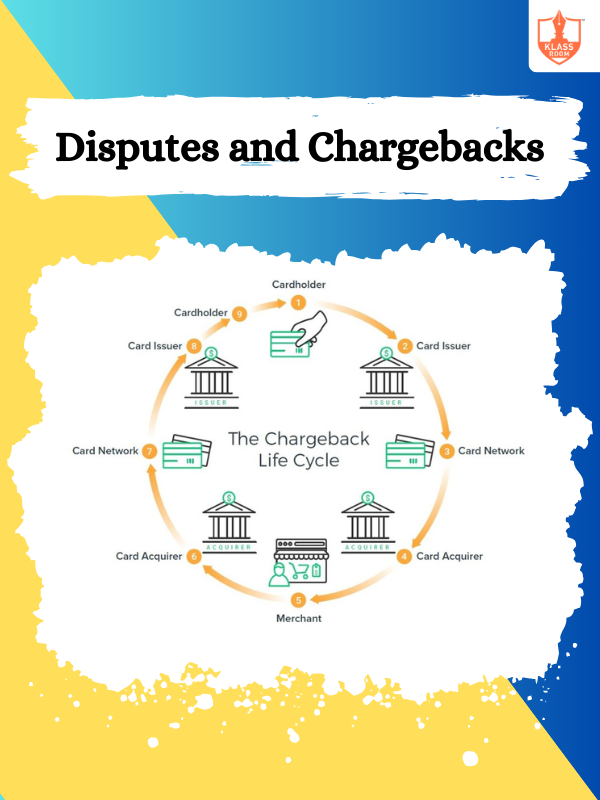

Disputes and Chargebacks

Description: Disputes and chargebacks involve customers contesting transactions, leading to potential refunds and merchant losses.

Types of Cards

Description: Types of cards include credit cards, debit cards, prepaid cards, charge cards, and gift cards.

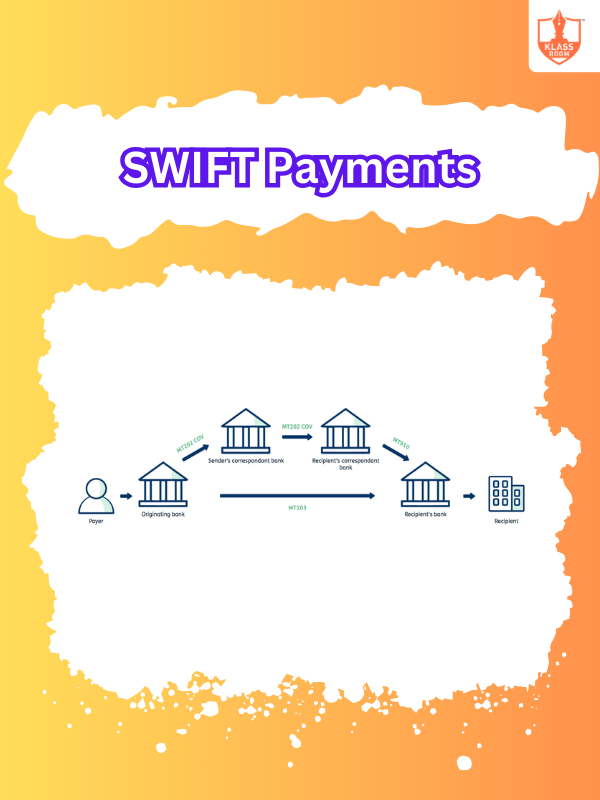

SWIFT Payments

Description: SWIFT payments are international money transfers conducted through the SWIFT (Society for Worldwide Interbank Financial Telecommunication) network, connecting banks globally.

Direct Debit

Description: Direct Debit is an automatic payment method where funds are withdrawn directly from a payer's bank account to pay recurring bills or subscriptions.

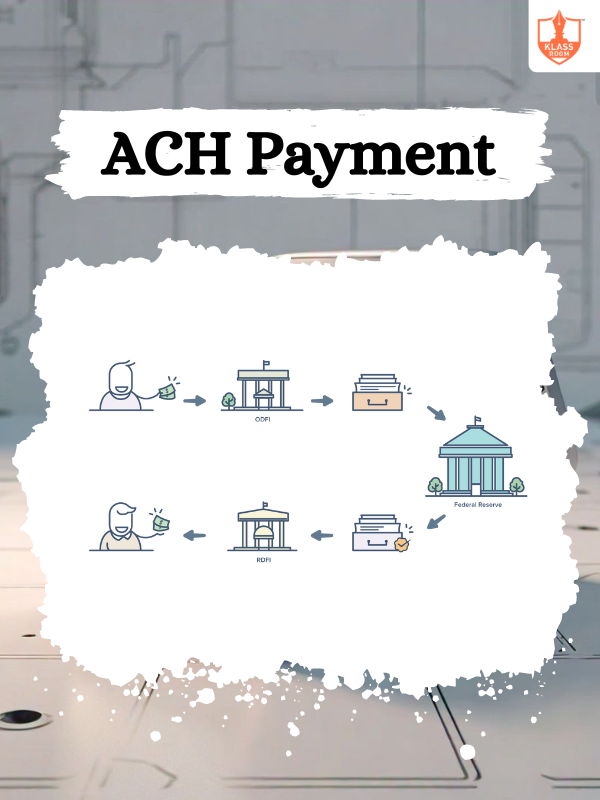

ACH Payment

Description: ACH (Automated Clearing House) payment is an electronic funds transfer system in the U.S. for processing direct deposits, bill payments, and other transactions between banks.

Intro to Fintech Apps

Description: Fintech apps streamline financial services like banking, payments, and investments, offering convenience and innovation

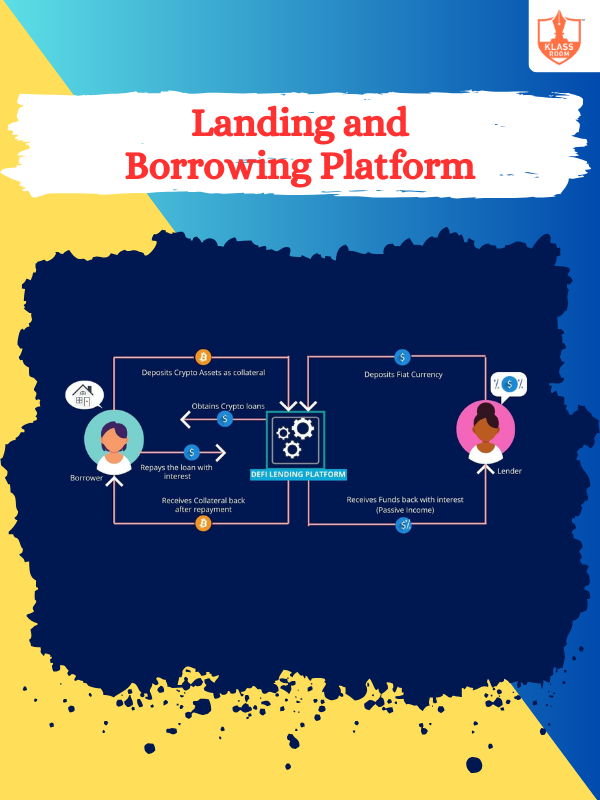

Landing and Borrowing Platform

Description: Lending and borrowing platforms connect borrowers with lenders online, facilitating peer-to-peer loans and alternative financing.

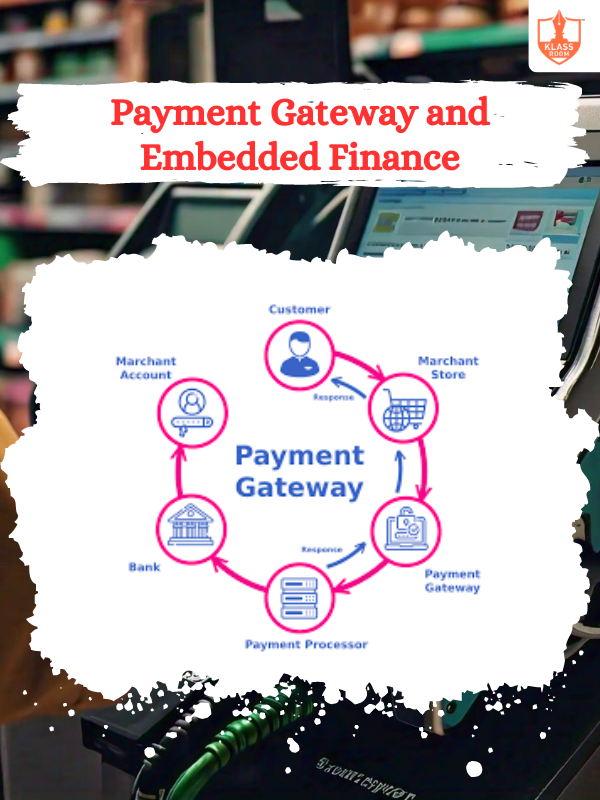

Payment Gateway and Embedded Finance

Description: Payment gateways enable secure online transactions, while embedded finance integrates financial services into non-financial platforms.

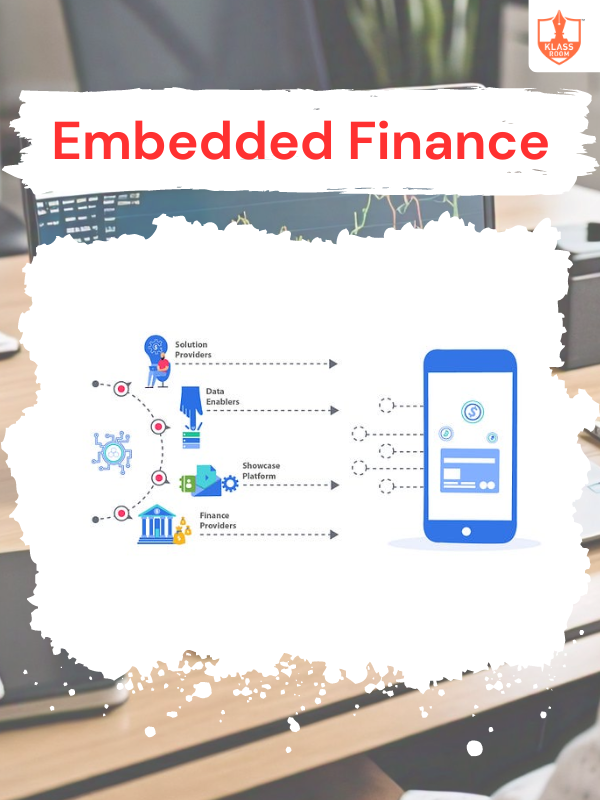

Embedded Finance

Description: Embedded finance integrates financial services like payments, lending, or insurance directly into non-financial platforms or apps.

Insurtech

Description: Insurtech leverages technology to innovate and improve insurance services, from underwriting to claims processing.

Investment Platform

Description: An investment platform provides tools and services for individuals to manage, invest, and grow their financial assets.

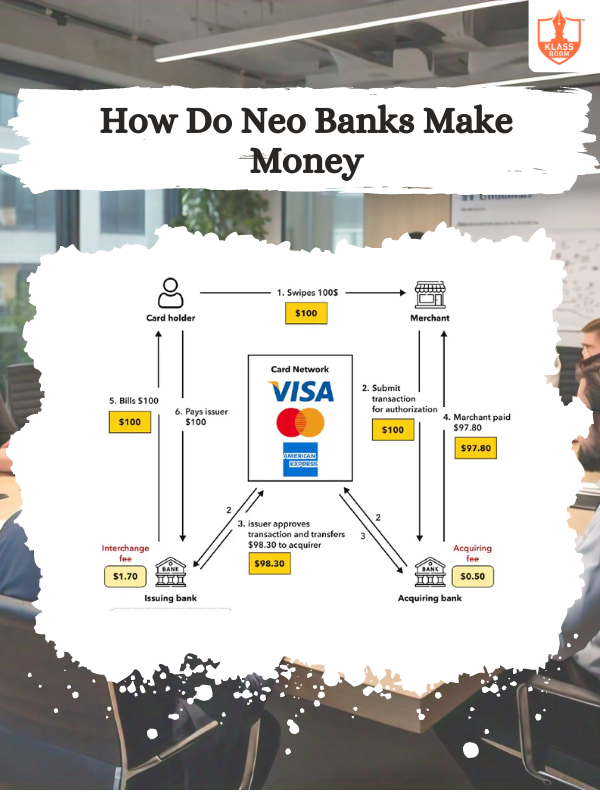

How Do Neo Banks Make Money

Description: Neobanks earn through interchange fees, subscription charges, interest margins, financial products, and partnerships.

Advanced Payment Technology - Part II

Description: Advanced payment technology enables secure, fast, and contactless transactions through digital platforms and innovative solutions.

DeFi

Description: DeFi, or decentralized finance, uses blockchain to create open, permissionless financial services without intermediaries.

E-Money and E-Wallet

Description: E-money represents digital currency, while e-wallets store and manage these funds for online transactions.

BaaS

Description: Banking as a Service (BaaS) offers financial services through APIs, enabling third-party integration with banks.

Web 1, 2, and 3

Description: Web 1: Static, read-only websites. Web 2: Interactive, user-generated content. Web 3: Decentralized, blockchain-based internet.